The full FEIE Standard Deduction breakdown for first-time expats

Wiki Article

Comprehending the Foreign Earned Income Exemption and Its Effect On Your Basic Reduction

The Foreign Earned Income Exemption (FEIE) supplies significant advantages for migrants, allowing them to leave out a part of their foreign-earned income from U.S. taxes. Nonetheless, claiming the FEIE can complicate one's tax obligation situation, particularly regarding the basic reduction. Comprehending this interaction is important for people living abroad. As migrants browse these complexities, they need to take into consideration how their options influence their overall tax obligation. What strategies can they utilize to optimize their monetary end results?What Is the Foreign Earned Income Exemption (FEIE)?

The Foreign Earned Revenue Exemption (FEIE) works as an essential tax obligation benefit for united state people and resident aliens functioning abroad. This provision enables qualified people to omit a significant part of their foreign-earned earnings from U.S. taxes, efficiently reducing their overall tax concern. The FEIE intends to reduce the financial pressure on migrants and encourages Americans to seek job opportunity in foreign markets. The exclusion uses to incomes, wages, and expert charges made while staying in an international country. The maximum exclusion quantity is changed every year for inflation, making sure that it continues to be pertinent to present economic problems. By making use of the FEIE, expatriates can maintain more of their earnings, promoting financial security while living overseas. On the whole, the FEIE plays an essential duty in shaping the monetary landscape for Americans abroad, facilitating a smoother change to international workplace and promoting financial involvement on an international scale.Qualification Demands for the FEIE

Eligibility for the Foreign Earned Revenue Exemption (FEIE) is contingent upon meeting particular criteria set by the Internal Earnings Solution (IRS) Mainly, individuals have to be U.S. people or resident aliens that earn revenue while living in a foreign country. To certify, they must please either main examinations: the Physical Existence Examination or the Authentic Residence Examination.The Physical Visibility Test calls for individuals to be literally existing in a foreign nation for a minimum of 330 full days within a 12-month duration - FEIE Standard Deduction. On the other hand, the Authentic House Test demands that people establish residency in a foreign nation for an undisturbed duration that includes an entire tax year

In addition, the earnings must be originated from individual solutions performed in the international country. Meeting these requirements permits taxpayers to exclude a considerable section of their foreign-earned revenue from united state taxation, consequently reducing their total tax obligation responsibility.

Exactly how to Declare the FEIE

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

To start the procedure, individuals must collect records that verify their foreign profits, such as pay stubs, tax obligation returns from international nations, and any pertinent employment agreement. It is necessary to ensure all revenue claimed under the FEIE is earned from foreign sources and satisfies the needed thresholds.

Additionally, taxpayers should think about filing target dates and any feasible expansions. Claiming the FEIE correctly not only aids in reducing tax obligation obligation however additionally guarantees compliance with IRS regulations. Correct documents and adherence to standards are vital for a successful claim of the Foreign Earned Earnings Exemption.

The Interaction In Between FEIE and Common Deduction

The communication between the Foreign Earned Income Exclusion (FEIE) and the basic reduction is an essential facet of tax preparation for migrants. Understanding the standard concepts of FEIE, in addition to the constraints of the conventional reduction, can substantially impact tax obligation declaring techniques. This area will check out these elements and their effects for taxpayers living abroad.FEIE Basics Described

While lots of expatriates seek to decrease their tax obligation concern, understanding the interaction between the Foreign Earned Revenue Exemption (FEIE) and the standard reduction is essential. The FEIE allows united state citizens and resident aliens living abroad to omit a certain quantity of foreign made earnings from U.S. taxation. This exclusion Learn More can significantly lower taxable earnings, potentially influencing eligibility for various other reductions, such as the conventional deduction. Remarkably, individuals who claim the FEIE can not additionally take the conventional reduction against the left out revenue. Therefore, expatriates have to meticulously evaluate their total revenue and deductions to optimize their tax scenario. Understanding of these interactions can cause more informed financial decisions and much better tax obligation techniques for expatriates guiding through their one-of-a-kind scenarios.Criterion Deduction Limitations

Comprehending the restrictions of the basic deduction in connection with the Foreign Earned Earnings Exclusion (FEIE) is necessary for migrants maneuvering their tax responsibilities. While the FEIE allows certifying people to exclude a specific amount of foreign-earned revenue from U.S. taxes, it can influence the conventional deduction they are qualified to insurance claim. Particularly, taxpayers who assert the FEIE can not likewise claim the standard deduction on that particular left out income. In addition, if a migrant's total income drops below the typical deduction threshold, they might not gain from it in any way. This interaction demands cautious preparation to optimize tax obligation benefits, as underutilizing the common reduction can lead to greater taxable income and increased tax obligation liability. Recognizing these constraints is vital for efficient tax approach.Tax Obligation Filing Ramifications

Navigating the tax obligation declaring ramifications of the Foreign Earned Income Exclusion (FEIE) requires cautious factor to consider of exactly how it interacts with the common deduction. Taxpayers making use of the FEIE can omit a substantial section of their foreign-earned earnings, but this exemption influences their eligibility for the conventional reduction. Specifically, if an individual cases the FEIE, they can not also declare the standard deduction for that earnings. This can cause a reduced total tax obligation however may make complex the declaring process. Additionally, taxpayers need to More Info assure conformity with IRS needs when submitting Kind 2555 for the FEIE. Understanding these communications is important for enhancing tax obligation advantages while avoiding prospective mistakes in the declaring procedure. Cautious planning can make best use of advantages and reduce liabilities.Prospective Tax Ramifications of Making Use Of the FEIE

The Foreign Earned Earnings Exclusion (FEIE) provides considerable tax benefits for united state citizens functioning abroad, but it likewise includes potential effects that require mindful consideration. One major effect is the effect on eligibility for sure tax obligation credit ratings and deductions. By choosing to use the FEIE, taxpayers might unintentionally reduce their modified gross earnings, which can limit accessibility to debts like the Earned Earnings Tax obligation Credit history or reduce the quantity of basic reduction offered.

Furthermore, people who make use of the FEIE might encounter complications when going back to the U.S. tax obligation system, especially worrying the taxation of future earnings. The exemption uses only to made earnings, meaning various other income kinds, such as dividends or passion, remain taxable. This distinction necessitates precise record-keeping to assure conformity. The FEIE may impact state tax responsibilities, as some states do not identify the exemption and might exhaust all income made by their homeowners, no matter of where it is earned.

Tips for Maximizing Your Tax Advantages While Abroad

While working abroad can be enriching, it also presents distinct chances to enhance tax obligation benefits. To take full advantage of these advantages, individuals must initially determine their eligibility for the Foreign Earned Revenue Exemption (FEIE) and consider the physical presence test or the authentic residence examination. Keeping in-depth documents of all income earned and costs sustained while overseas is crucial. This documentation supports insurance claims for reductions and credit ratings.In addition, understanding the tax helpful site treaties between the USA and the host country can help stay clear of dual taxes. People should also discover contributions to tax-advantaged accounts, such as Individual retirement accounts, which might provide additional deductions.

Last but not least, seeking advice from a tax specialist focusing on expatriate tax obligation law can supply tailored techniques and guarantee conformity with both U.S. and foreign tax obligation responsibilities. By taking these actions, migrants can effectively boost their economic situation while living abroad.

Frequently Asked Concerns

Can I Make Use Of FEIE if I Work for a Foreign Government?

Yes, an individual can utilize the Foreign Earned Earnings Exemption (FEIE) while functioning for a foreign government, given they satisfy the requisite problems detailed by the internal revenue service, consisting of the physical visibility or authentic residence tests.

Does FEIE Apply to Self-Employment Revenue?

The Foreign Earned Revenue Exemption (FEIE) does put on self-employment revenue, provided the private satisfies the required demands. Qualified freelance individuals can omit qualifying income earned while living in an international country from tax.What happens if My International Revenue Exceeds the FEIE Restriction?

The excess amount may be subject to United state tax if foreign earnings surpasses the FEIE restriction. Taxpayers must report and pay taxes on the earnings over the exclusion threshold while still profiting from the exclusion.Can I Assert the FEIE and Make A List Of Deductions?

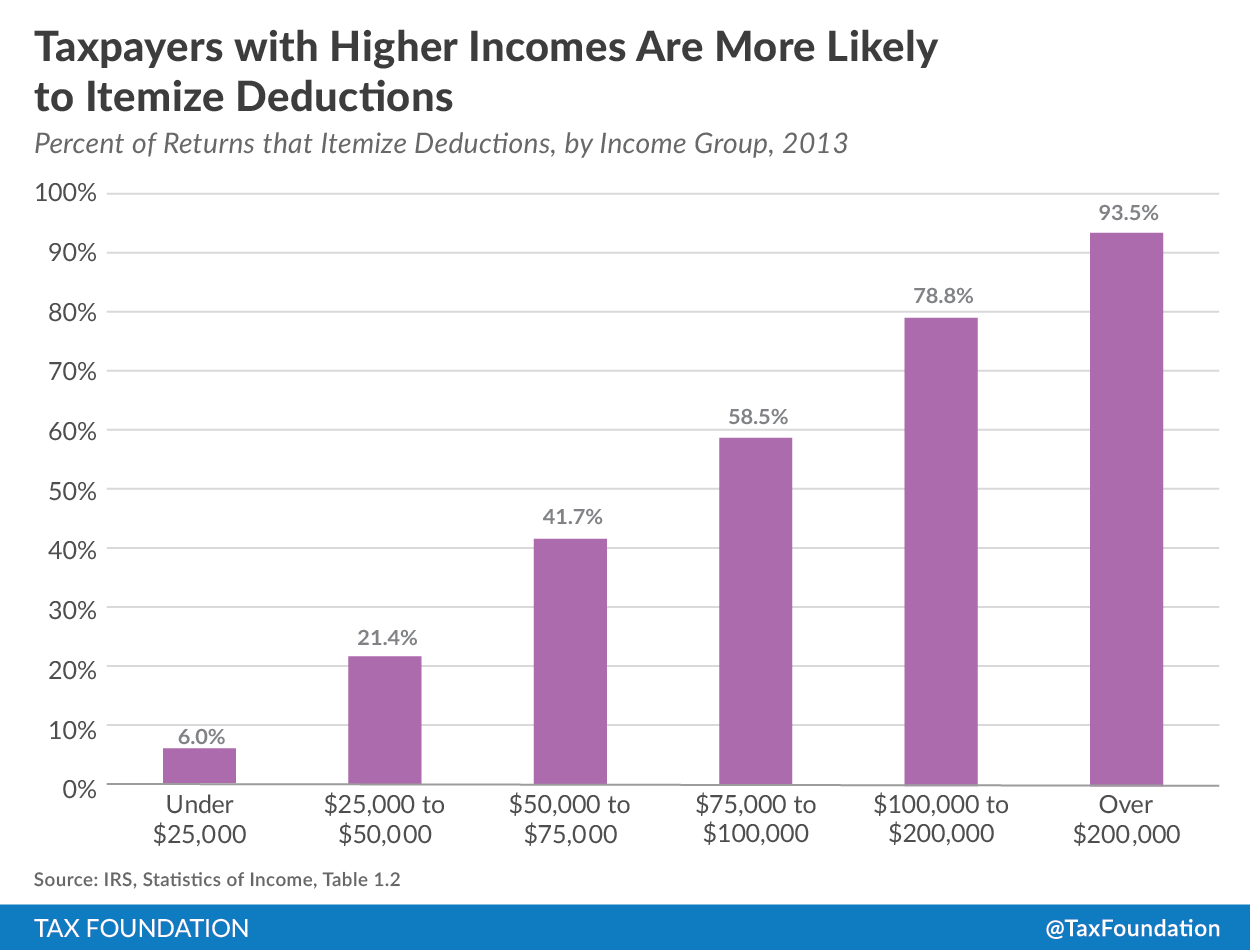

Yes, individuals can claim the Foreign Earned Earnings Exclusion (FEIE) while likewise itemizing reductions. Nevertheless, they need to understand that asserting the FEIE may affect the schedule of particular itemized deductions on their tax return.Exactly How Does FEIE Impact My State Tax Obligations?

The Foreign Earned Income Exclusion can reduce state tax responsibilities, as numerous states follow federal standards. Individual state guidelines vary, so it's necessary to consult state tax policies for particular effects on tax responsibilities.The Foreign Earned Income Exemption (FEIE) uses considerable advantages for expatriates, allowing them to omit a portion of their foreign-earned revenue from United state taxes. While several expatriates seek to minimize their tax concern, understanding the communication in between the Foreign Earned Earnings Exclusion (FEIE) and the conventional deduction is necessary. Understanding the restrictions of the common deduction in relationship to the Foreign Earned Revenue Exclusion (FEIE) is important for expatriates navigating their tax responsibilities. The exemption applies just to made earnings, indicating various other income kinds, such as rewards or rate of interest, continue to be taxable. The Foreign Earned Income Exclusion (FEIE) does use to self-employment earnings, provided the private satisfies the required needs.

Report this wiki page